Key messages

- In the last decade, the agri-food sector has witnessed intense changes as a result of various political, economic, sociocultural, technological, legal, and environmental factors.

- These huge challenges the industry is facing today, offer interesting opportunities throughout the entire food value chain.

- New entrants are challenging incumbents when it comes to accommodating to new consumer tastes, preferences and demand for personalization

- Entrepreneurs that are looking how to exploit new food functionalities, new food products and new ingredients are joining forces or relying on third parties. This has resulted in a strong convergence between food & beverage and other industries such as cosmetics and health care.

Ripe for disruption

The agri-food sector, traditionally seen as a slow adopter of change, is witnessing a phase of rapid and intense transformations. The pace at which new food trends, food technologies and business models are launched seems to be ever increasing, as evidenced by the multitude of reports describing the future of food and the agri-food industry. These reports, as well as the high number of new entrants and high level of investments indicate that the sector, or at least parts of its value chain, are ripe for disruption. The huge challenges the industry is facing today, such as food supply, food security, and food waste, offer interesting opportunities throughout the entire food value chain. The range, diversity and speed of these changes are, however, overwhelming. Not only for aspirant entrepreneurs, but also for incumbents. The complexity of these dynamics makes it challenging to spot and seize the best opportunities. On top of that, the different players within the agro-food value chain are impacted differently. It is, therefore, essential to create the proper framework to capture these trends and challenges (data analysis), translate them into actionable insights for the company (insights and knowledge building), and define the best-fitting growth opportunities. This blog post sheds light on severalContinuous need for innovation

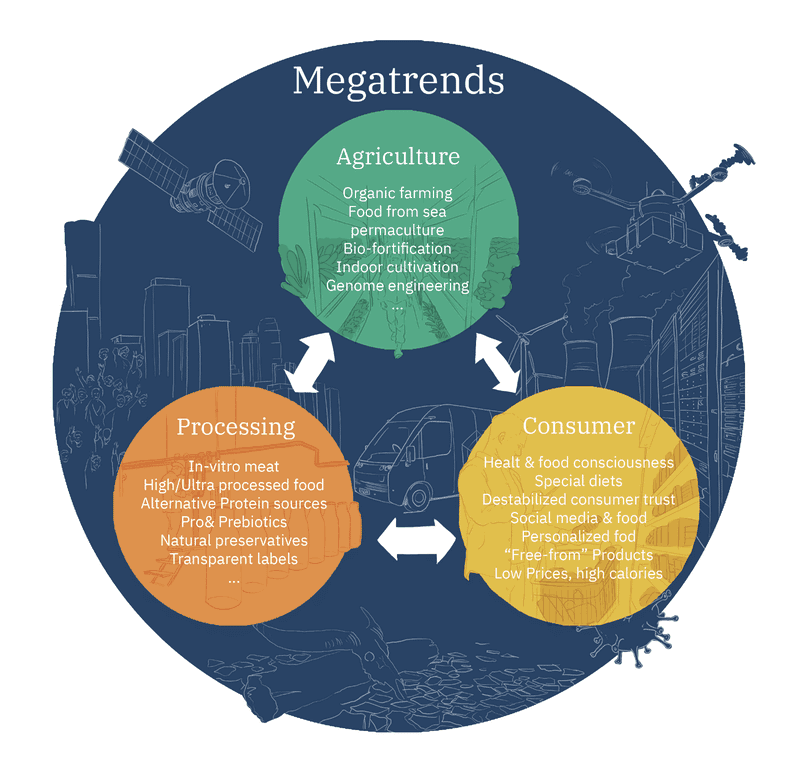

Food has long been regarded exclusively as a primary human need. The way people look at food and food consumption has remained fairly consistent over the past five decades. However, this perspective has become much too restrictive and no longer reflects how modern society views nutrition in its totality. Furthermore, several political, economic, socio-cultural, technological, legal and environmental factors have intensified this evolution and the entire agri-food sector, from agricultural production, through food processing and distribution, to retail has been disrupted as a result (Figure 1). And very recently, the global pandemic has exposed unexpected weaknesses in our food supply chain as well.

It is perhaps unrealistic to expect that the entire world will drastically switch to a sustainable dietAnd finally, sustainability, health and freshness (short go2market time) have become key decision factors for consumers to buy food products. All these elements together put significant pressure on the food industry to innovate and also shorten the go-to-market time. For each of these issues,

The playing field

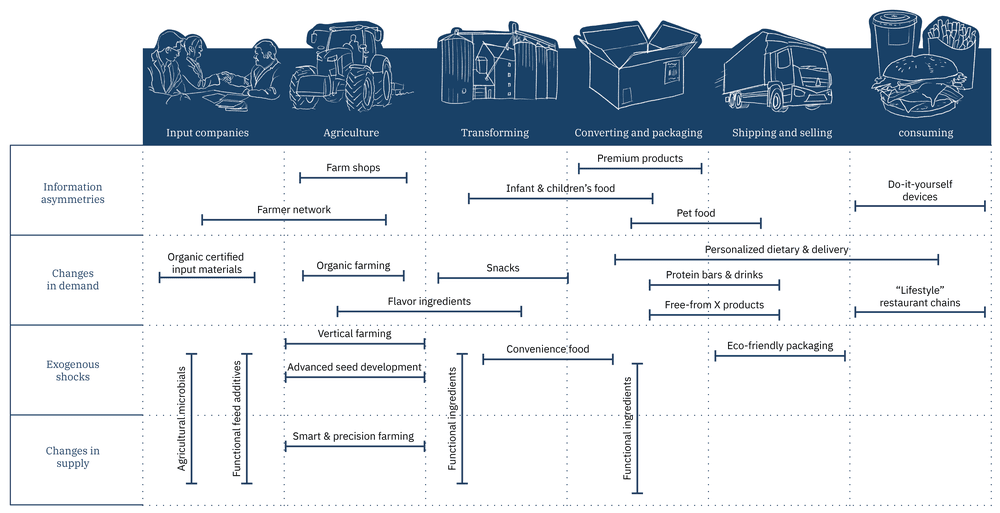

The playing field in the agri-food industry has changed radically. In the past, large players dominated the industry and competition was battled by, for example, keeping production costs as low as possible. Despite growth across the industry, the large established companies have faced declining sales. A major reason for this is the intensified competition from new entrants. Newcomers, usually smaller companies, are very skilled at adapting to new tastes and personal preferences of consumers, allowing them to capture a significant share of the market. Moreover, the new companies also effectively steer and redefine consumer expectations through their offerings of differentiating value propositions. But the disruption also comes from an unexpected side: veterans from technology and finance have invested heavily in food and agricultural technologies in recent years. This battle for the food market is not new, but the pace and number of disruptors is unseen. And this is reflected in the fact that growth in the food sector in recent years has come mostly from companies outside the top 20.Impact on the value chain

Consumers eventually drive the market and their food behavior. Different players in the value chain all have a role to play to meet those fast changing needs. This is not always orchestrated. Monitoring of trends and technological changes has therefore become an indispensable part of the current innovation management of food companies.

The entrepreneurial opportunity space

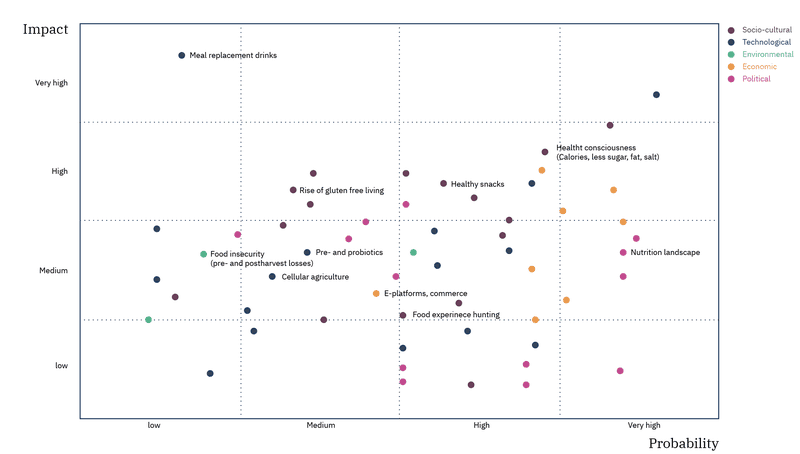

Somewhat a decade ago, people may have wondered whether plant-based nutrition would be a long-term trend. Now, 10 years later, plant-based alternatives to e.g. meat are a rapidly growing market segment. Early believers have taken advantage, but newcomers to the field are wondering how to successfully hitch a ride on this success. There is always risk involved in the choices a company makes, especially when it comes to longer-term strategy. Whether your company is a leader or (smart) follower, we find it essential to spot interesting opportunities through an unbiased impact-probability framework (Figure 3). Impact reflects the disruptive effect of a technology in an (application) domain, while the probability that a technology will enter this domain is determined both by the probability and the speed of the trend. Both of these variables are most effectively captured by the objective interpretation of data, and trends therein, from a variety of complementary sources. This combination of sources such as papers, patents, VC flows, start-up databases, market reports, etc. reflect the diffusion of technology from research, through development to commercialization. The resulting framework not only allows for a clear prioritization, but also a clustering of opportunities under different future scenarios. In this way, a company can confidently shape their innovation strategy and portfolio, balancing a reactive and a proactive approach, both in the short, medium and long term.

Innovate with the world

The agro-food sector is also starting to be open to find inspirations from other sectors and even join forces. Several players in the agro-food sector have converged with other industries to develop disruptive innovative products with success. New product categories such as nutricosmetics, cosmeceuticals, nutraceuticals are emerging as a result of a convergence between the food & beverage industry and the cosmetics & health sector. Another example is seen in pet food. Food trends for people are being adopted to pet food at an increasing rate as they are driven by the growing interest of people who really care more about what their pets eat. It should come as no surprise, then, that nutraceuticals have become available in both conventional pet foods and individual supplements. When it comes to digestive health, the pet food industry has led the way by developing and applying various pre- and probiotic supplements. Some bioactive components are known to have beneficial effects in multiple areas ranging from health, wellness, nutrition to cosmetics. Ingredients containing such bioactive compounds (e.g., spices and botanicals) can thus find applications in multiple industries, opening up prospects for ingredient companies looking to diversify their channels.How?

Innovation requires companies to beOpen innovation models lead to significant changes in the entrepreneurial behavior of the food industryKnowing all this, how can a company know how to respond to the political, economic, socio-cultural, technological, ecological and legal (PESTEL) drivers that will affect them in one way or another? The answer lays in the combination of outside-in (

- Megatrends in the agri-food sector: global overview and possible policy response from an EU perspective (https://www.europarl.europa.eu/RegData/etudes/STUD/2019/629205/IPOL_STU(2019)629205_EN.pdf)

- Kuckertz et al. (2019) Entrepreneurship and entrepreneurial opportunities in the food value chain https://www.nature.com/articles/s41538-019-0039-7

- https://foodtechconnect.com/2015/02/16/why-the-foodservice-industry-is-ripe-for-disruption/

- Bigliardi et al. (2020) Innovation Models in Food Industry: A Review of The Literature https://scielo.conicyt.cl/scielo.php?script=sci_arttext&pid=S0718-27242020000300097

- https://farmweek.com/us-firm-identifies-technologies-that-will-help-reshape-agriculture/

- https://fit4food2030.eu/wp-content/uploads/2018/10/FIT4FOOD2030_D2.1_Report_on_trends_final-compressed.pdf

- https://www.petfoodindustry.com/articles/9821-human-food-trends-for-pet-food-in-2021?v=preview

Download the paper "The response of the agro-food sector to a fast changing world"

Related Cases

Camping case

Discover how Creax can help identify new opportunities and innovate products by utilizing a human-centered design approach in this camping case study.

The healthy snack

What is a ‘healthy snack’? What about clean label? How can they be made in compliance with existing production processes, and is scalable? A comprehensive mapping of activities in this field can help.

Cultured meat

Cultured meat. A buzzword or the future? Unbiased insights about research and development activities create confidence to determine a company’s position and role in this landscape.

New food functionalities

Adding functionalities to food leads to immediate gains, for consumers and for companies. Companies therefore want to know what to focus on to build a product portfolio. A complete mapping of technologies, ingredients and producers, supported by scientific evidence, practically leads to immediate alignment with consumer needs.